Withholding/Fee Template

Overview

The Withholding/Fee Template facilitates either the payment of fees by a select class (or classes) of investors, or withholds a portion of the allocated distribution from a select class (or classes) of investors. Typically this is used for Asset Management Fees and/or Tax Withholdings.

Preconditions

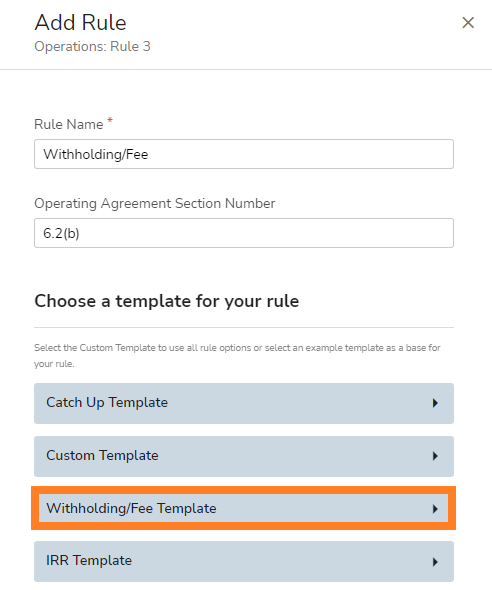

When adding a Withholding/Fee rule to a waterfall ruleset, you must first select the Withholding/Fee Template. This defines how IMS determines/calculates the total Withholding/Fee amount, as well as the display of the Withholding/Fee amounts on the Investor Portal for each applicable investor. If a Withholding/Fee Template does not exist or if the existing Template(s) do not meet the parameters for the Withholding/Fee Rule, you must create a new Withholding/Fee Template. For a detailed explanation of all waterfall templates and rule calculations, click here.

Rule Inputs

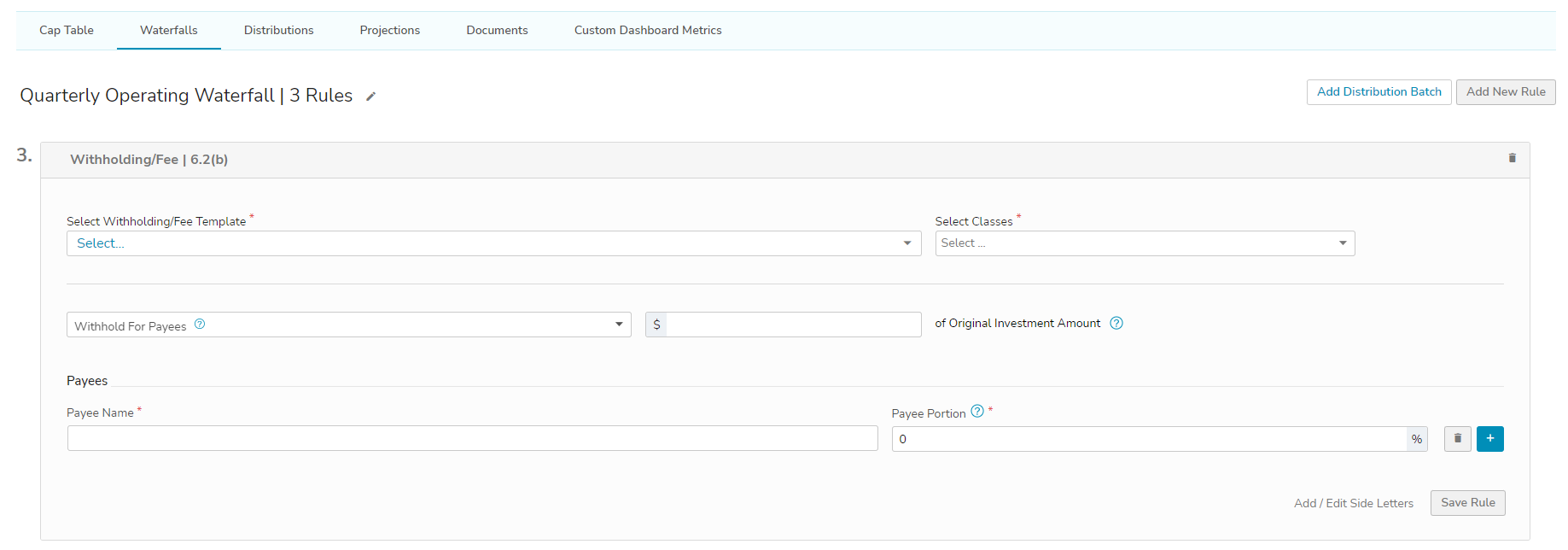

- Withholding/Fee Template: The Withholding/Fee Template defines how the total Withholding/Fee amount should be determined by IMS and displayed on the Investor Portal.

- Classes: Select the Class(es) of investors that are paying the fee and/or having a portion of their allocated distribution withheld.

- Withholding/Fee: Select the appropriate verbiage for the Withholding/Fee Waterfall Rule – Withhold for Payees or Pay to Payees.

- Dollar/Percentage Amount: Depending on the parameters selected in the Withholding/Fee Template, the user will have the ability to key in the dollar amount or percentage pertaining to the Withholding/Fee Waterfall Rule.

- Payees: Select the individual(s)/entities that should receive the total Withholding/Fee amount and key in the percent entitled to each party. By default, the Withholding/Fee Rule starts with space for a single payee; however, if there are multiple Payees, you may add the appropriate parties and their entitled portion of the Withholding/Fee amount by clicking the blue '+' button to the right.

Withholding/Fee Template

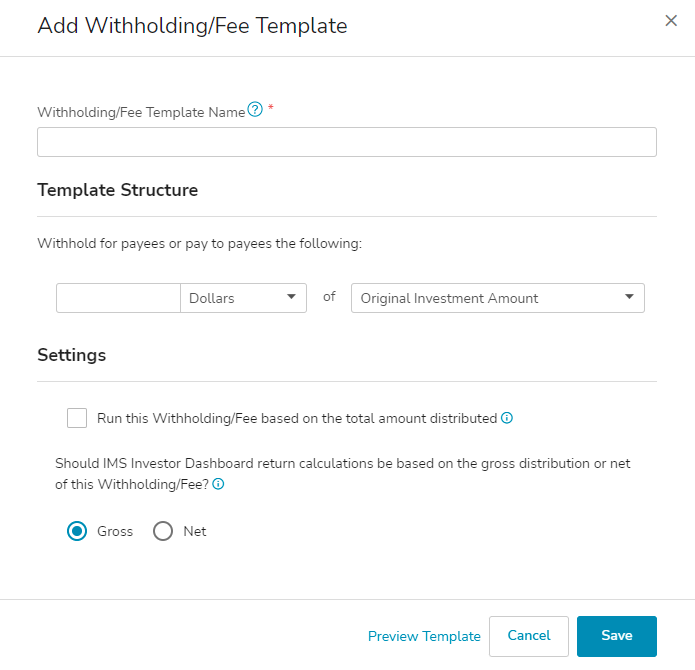

As mentioned above, the Withholding/Fee Waterfall Rule requires you to first fill out a Withholding/Fee Template, which features 3 sections of variable inputs used for the Withholding/Fee Waterfall Rule – Template Name, Template Structure, and Settings. Once saved, each Withholding/Fee Template is available to use for other project waterfalls in IMS.

Template Name: A required field for giving the Withholding/Fee Template a unique name – Typically a name that describes the intended Waterfall Rule format, for example: 'Asset Management Fee – 1%' or 'Federal Tax Withholdings'

Template Structure: Defines whether the Withholding/Fee amount is based on a fixed dollar amount or a percentage (leftmost dropdown box) of the Original Investment Amount, Total Distribution, Remaining Capital, or a Custom Amount (right-most dropdown box). Best practice is to make a selection for both dropdown boxes and key in the appropriate value in the textbox immediately left of the leftmost dropdown box.

-

- Original Investment Amount, Total Distribution, and Remaining Capital are values derived from IMS.

- Custom Amount: If none of the IMS-generated values do not fit the criteria of the Withholding/Fee Rule being added, the Custom Amount allows you to key in another value to base the Withholding/Fee off of. This amount is entered into IMS at the time you are adding a distribution batch.

- Please note that even if the Withholding/Fee amount is based on a fixed dollar amount, a selection still needs to be made for the right-most dropdown box, which includes Original Investment Amount, Total Distribution, Remaining Capital, or a Custom Amount; however, this selection will not impact the calculation for allocating the Withholding/Fee amount among the selected class or classes.

Settings

- 'Run this Withholding/Fee based on the total amount distributed'

- If this box is checked, then the Withholding/Fee amount will be taken out of the selected classes' distributions and allocated to the selected Payees no matter where the Withholding/Fee Rule falls within the Waterfall Ruleset.

- If this box is not checked, and the Withholding/Fee Rule is not the first waterfall rule within the waterfall ruleset, the Withholding/Fee amount will not be taken out until the higher priority waterfall hurdles have been satisfied.

- The Gross/Net radio buttons determine how returns should be displayed to your investors. For example:

- If Gross is selected, the investor's returns will reflect their gross distribution amount before any withholdings/fees were taken out.

- If Net is selected, the investor's returns will reflect their net distribution amount after any withholdings/fees are taken out.