Preferred Return Template

Overview

The Preferred Return template is designed to calculate preferred returns due to investors of one or more classes in a Project at a rate set for that class. By default, the system calculates Preferred Returns at an Investment-level. These calculations use the latter of the Project Close Date or the individual Investment Date when accruing. The system provides powerful flexibility around day counts, compounding, and overrides which are discussed below. All distributions derived from this rule will be placed into the Preferred Return bucket to ensure consistency and accurate calculations on a go-forward basis.

Pre-Conditions For Use

The Entity must have one or more Classes that have a Preferred Return Rate Populated (see Edit Classes page). If a Preferred Return Rate is not populated, you will not be able to choose the preferred Return Template.

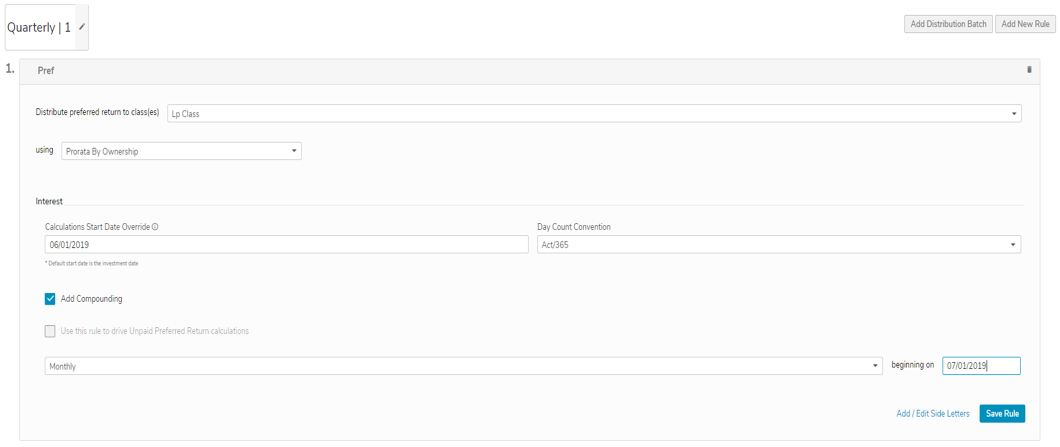

The screenshot below shows a Preferred Return template with two (2) required fields and five (5) optional fields to complete the setup:

Input Fields:

Classes: You can select more than one if both classes are equal in priority for payment. If they are not, you will want to set up separate Preferred Return Rules in the order that matches the class priority.

Distribution Allocation Method: Tells the system how to allocate the distribution amount between the investors in the event you are not paying the total accrued amount in a distribution batch. Choose from:

- Pro-rata by Ownership: Amount distributed will be allocated according to each investor’s class ownership percentage.

- Pro-rata by Unpaid Preferred Return: Amount distributed will be allocated according to each investor’s percentage of the total amount of unpaid preferred return. For example, if you are distributing $50,000 but $100,000 of preferred return is accrued total to all investors and John Smith has accrued $1000 (1%), he will be paid 1% of the total distribution amount, or $500.

- Equal Distributions: Everyone receives the exact same amount (one-off).

Calculations Start Date Override:

As mentioned above, the IMS system defaults to the latter of the Project Close Date or the investor’s Investment Date for the start date on Preferred Return accruals. There are several instances where an override may be appropriate, as listed below:

- You may wish to begin pref accruals as of a future date other than the Investment Date (date of eSignature completion unless otherwise specified) or the Project Close Date (specified on the Edit Project page). Note this will not allow you to use a date prior to either of these as the system will always look to the latest date.

- Development project where investors do not accrue pref for the first six months or some other pre-determined construction timeline.

- You have a rate step in the future that needs to be accounted for in conjunction with a basepoint.

Day Count Convention:

This drive's how the preferred return accrual will be calculated. If you select nothing, the system will default to Actual/Actual. The system will support Actual/Actual (accounts for the extra day in a leap year), Actual/365, Actual/360, and 30/360. Please see your Operating Agreement to determine if you need to make a selection other than Actual/Actual.

Compounding:

Some Operating Agreements may require compounding on unpaid preferred returns. If you select the “Add Compounding” check box, you will need to input the following:

- Frequency: Daily, Monthly, End of Month, Quarterly, Annually. Select the frequency of compounding that matches your operating agreement, if applicable.

- Compounding Begin Date: Input the date you want compounding to begin accruing based on your Operating Agreement, if applicable.